Natural monopolies

Natural monopolies

A natural monopoly is a distinct type of monopoly that may arise when there are extremely high fixed costs of distribution, such as exist when large-scale infrastructure is required to ensure supply. Examples of infrastructure include cables and grids for electricity supply, pipelines for gas and water supply, and networks for rail and underground. These costs are also sunk costs, and they deter entry and exit.

In the case of natural monopolies, trying to increase competition by encouraging new entrants into the market creates a potential loss of efficiency. The efficiency loss to society would exist if the new entrant had to duplicate all the fixed factors – that is, the infrastructure.

It may be more efficient to allow only one firm to supply to the market because allowing competition would mean a wasteful duplication of resources.

Economies of scale

With natural monopolies, economies of scale are very significant so that minimum efficient scale is not reached until the firm has become very large in relation to the total size of the market.

Minimum efficient scale (MES) is the lowest level of output at which all scale economies are exploited. If MES is only achieved when output is relatively high, it is likely that few firms will be able to compete in the market. When MES can only be achieved when one firm has exploited the majority of economies of scale available, then no more firms can enter the market.

Utility companies

Natural monopolies are common in markets for ‘essential services’ that require an expensive infrastructure to deliver the good or service, such as in the cases of water supply, electricity, and gas, and other industries known as public utilities.

Because there is the potential to exploit monopoly power, governments tend to nationalise or heavily regulate them.

Regulators

If public utilities are privately owned, as in the UK since privatisation during the 1980s, they usually have their own special regulator to ensure that they do not exploit their monopoly status.

Examples of regulators include Ofgem, the energy regulator, and Ofcom, the telecoms and media regulator. Regulators can cap prices or the level of return gained.

Railways as a natural monopoly

Railways are often considered a typical example of a natural monopoly. The very high costs of laying track and building a network, as well as the costs of buying or leasing the trains, would prohibit, or deter, the entry of a competitor.

To society, the costs associated with building and running a rival network would be wasteful.

Avoiding wasteful duplication

The best way to ensure competition, without the need to duplicate the infrastructure, is to allow new train operators to use the existing track; hence, competition has been introduced, without duplication of costs. This is called opening-up the infrastructure.

This approach is frequently adopted to deal with the problem of privatising natural monopolies and encouraging more competition, such as:

- Telecoms, the network is provided by BT

- Gas, the network is provided by National Grid (previously Transco)

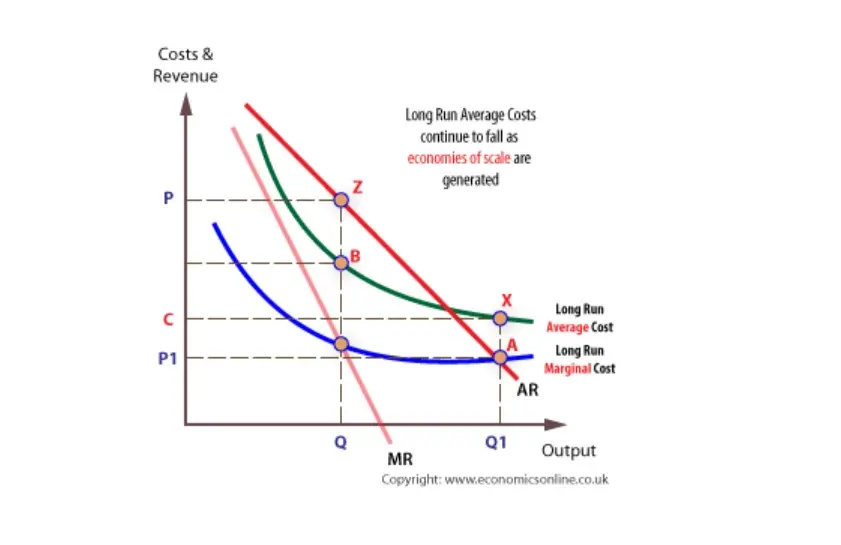

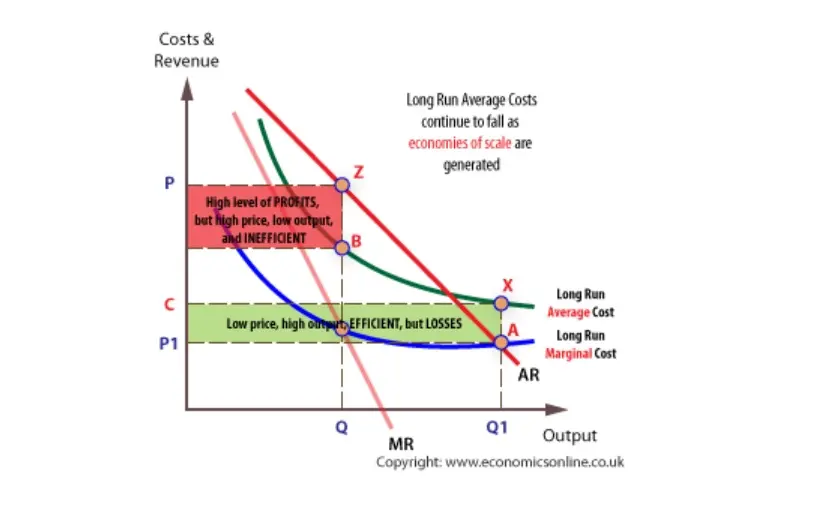

With a natural monopoly, average total costs (ATC) keep falling because of continuous economies of scale. In this case, marginal cost (MC) is always below average total cost (ATC) over the whole range of possible output.

Profits

In order to maximise profits the natural monopolist would charge Q, and make super-normal profits. If unregulated, and privately owned, the profits are likely to be excessive. In addition, the natural monopolist is likely to be allocatively and productively inefficient.

Losses

To achieve allocative efficiency, the regulator will have to impose an excessive price-cap (at P1). The output needed to be allocatively efficient, at Q1, is so high that the natural monopolist is forced to make losses, given that ATC is above AR at Q1. Allocative efficiency is achieved when price (AR) = marginal cost (MC), at A, but at this price, the natural monopolist makes a loss.

A public utility’s losses could be dealt with in a number of ways, including:

- Subsidies from the government.

- Price discrimination, whereby additional revenue can be derived by splitting the market into two or more sub-groups, and charging different prices to each sub-group.