Efficiency

Efficiency

Assessing the efficiency of firms is a powerful means of evaluating performance of firms, and the performance of markets and whole economies. There are several types of efficiency, including allocative and productive efficiency, technical efficiency, ‘X’ efficiency, dynamic efficiency and social efficiency.

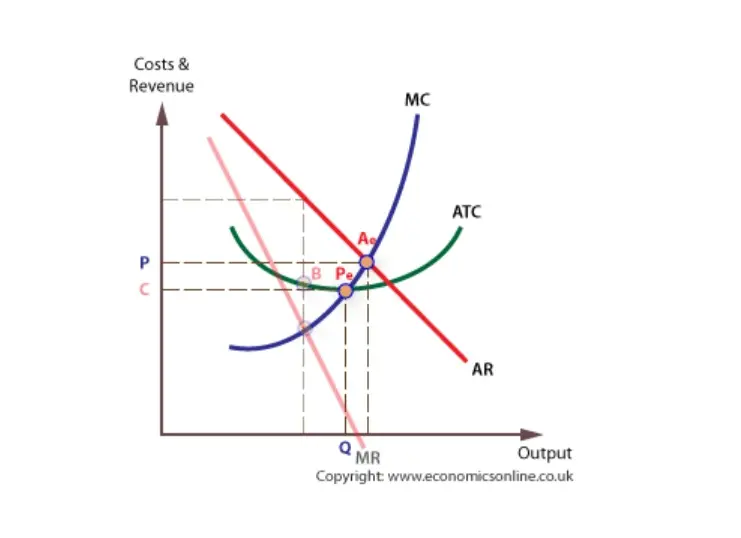

Allocative efficiency occurs when consumers pay a market price that reflects the private marginal cost of production. The condition for allocative efficiency for a firm is to produce an output where marginal cost, MC, just equals price, P.

Productive efficiency

Productive efficiency occurs when a firm is combining resources in such a way as to produce a given output at the lowest possible average total cost. Costs will be minimised at the lowest point on a firm’s short run average total cost curve.

This also means that ATC = MC, because MC always cuts ATC at the lowest point on the ATC curve.

Technical efficiency

Technical efficiency relates to how much output can be obtained from a given input, such as a worker or a machine, or a specific combination of inputs. Maximum technical efficiency occurs when output is maximised from a given quantity of inputs.

The simplest way to differentiate productive and technical efficiency is to think of productive efficiency in terms of cost minimisation by adjusting the mix of inputs, whereas technical efficiency is output maximisation from a given mix of inputs.

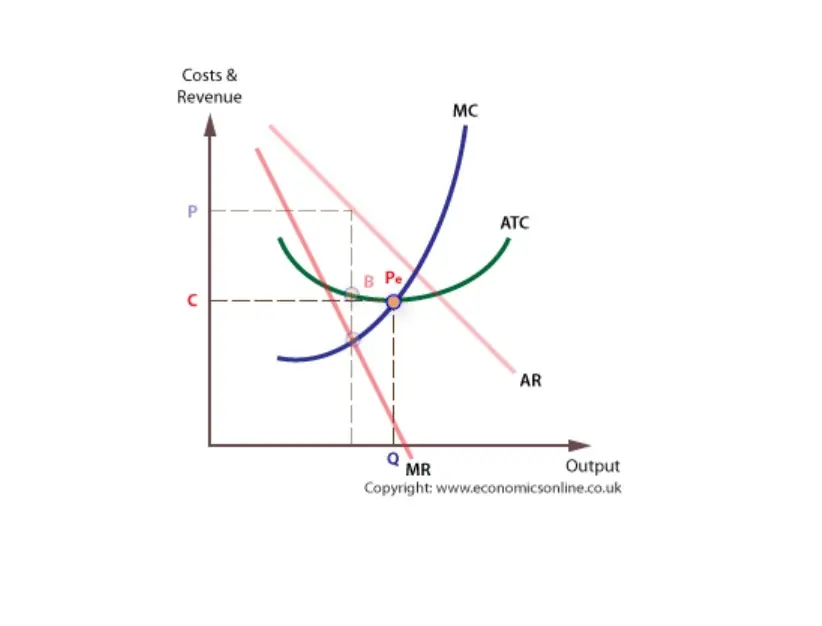

Identifying allocative and productive efficiency points

To identify which output a firm would produce, and how efficient it is, we need to combine data on both costs and revenue.

We can assume that most real firms face a downward sloping demand (AR) curve, and MR falls at twice the rate.

Diagrammatically, productive efficiency occurs where ATC is at its lowest, and is equal to MC.

‘X’ efficiency

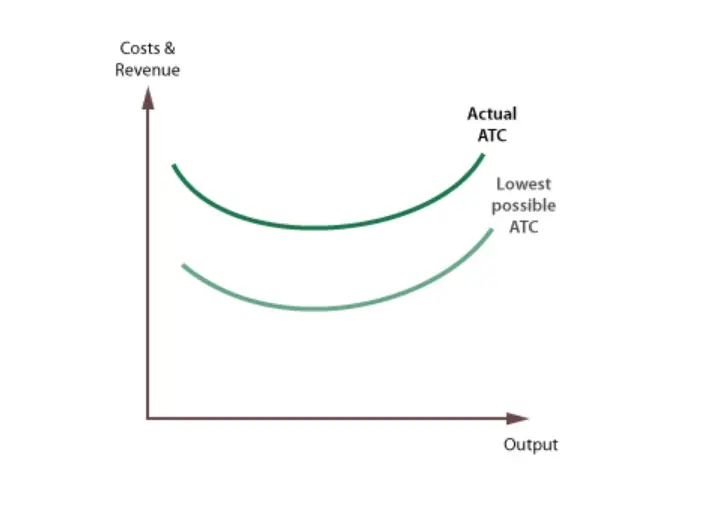

X efficiency is a concept that was originally applied to management efficiencies by Harvey Leibenstein in the 1960s. The concept can be applied specifically to situations where there is more or less motivation of management to maximise output, or not.

X efficiency occurs when the output of firms, from a given amount of input, is the greatest it can be. It is likely to arise when firms operate in highly competitive markets where managers are motivated to produce as much as possible.

When markets are less than perfectly competitive, as in the case of oligopolies and monopolies, there is likely to be a loss of ‘X’ efficiency, with output not being maximised due to a lack of managerial motivation.

The concept of dynamic efficiency is commonly associated with the Austrian Economist Joseph Schumpeter and means technological progressiveness and innovation.

Neo-classical economic theory suggests that when existing firms in an industry, the incumbents, are highly protected by barriers to entry they will tend to be inefficient. Schumpeter argued that this is not necessarily the case; indeed, firms that are highly protected are more likely to undertake risky innovation, and generate dynamic efficiency.

Firms can benefit from two types of innovation

- Process innovation occurs when new production techniques are applied to an existing product. For example, this is common in the production of motor vehicles with firms constantly looking to develop new methods and production processes.

- Product innovation occurs when firms generate new or improved products. For example, this is common in many consumer product markets, including electronics and communications.

Social efficiency

Social efficiency exists when all the private and external costs and benefits are taken into account when producing an extra unit. Private firms only have an incentive consider external costs into account if they are forced to internalise them through taxation or through the purchase of permit to pollute.

Knowledge and efficiency

Information failure is a type of inefficiency that can affect markets and firms in certain circumstances. There are various types of information failure.

The principal-agent problem

The principal-agent problem is associated with large firms, where ownership and control are in the hands of different people.

The principal-agent problem can occur whenever owners of a firm appoint managers to make key decisions. The owners are the principals, and those appointed to run and manage the business are the agents. This separation causes asymmetric information, where the agents know more than the owners do, and this creates the need for owners to construct mechanisms to monitor and check the performance of agents. The problem develops because the owners and managers usually have different objectives, so the owners cannot trust the managers to act on their behalf, creating the need for constant checking. This leads to inefficiencies in terms of the need to employ checkers and complex monitoring systems.

The principal-agent problem is most often associated with larger firms, especially plcs, where ownership is by shareholders, but directors and managers make decisions.

The principal-agent problem can also occur in the public sector, where the government (as principals) appoint managers to undertake the day-to-day operations of publicly owned enterprises. Conflicts between agents and principals can frequently occur. For example, managers of the railway network may want to generate maximum revenue, whereas the government may want a safer railway system.

Solutions to the principal-agent problem

A firm can adopt a number of strategies to resolve the principal-agent problem, including:

- Allocating shares to managers of a firm, so that they understand the shareholders’ objectives, and are more likely to consider their view when making day-to-day decisions.

- Using incentives tied to profits, such as with performance-related pay.

Moral hazard and adverse selection

Moral hazard

There are several other notable implications of asymmetric information, including moral hazard and adverse selection.

Moral hazard occurs when people alter their normally careful behaviour in the belief that someone else will deal with the effects of their careless behaviour.

This occurs because either:

- They think ‘they can get away with it’. Asymmetric knowledge means the person predicts that they are not likely to be found out, such as a manager not bothering to keep costs to a minimum.

- Or because they think they are ‘insured’ against the damage and loss associated with the behaviour – ‘..if I get it wrong someone else will come to the rescue…’.

Adverse selection

Adverse selection occurs as a result of asymmetric knowledge, as is well illustrated in the lemons problem. When parties to a transaction are ignorant of certain aspects of the transaction, such as the quality of the product they are buying, they are forced to make assumptions, often based on price. For example, a buyer may assume that goods are of poor quality if their price is low, and that goods are of high quality if their price is high.

In some markets, only low quality products will be sold, the so-called lemons problem. The lemons problem was first analysed by American economist George Akerlof in 1970. Akerlof explored the problem associated with pricing second hand cars in the USA, which he called a lemons market – a ‘lemon’ is a derogatory term for a poor-quality second-hand car. However, the lemon’s problem has wider implications in terms of understanding information failure in general.

For example, in terms of second hand cars, buyers may be suspicious of the motives of seller, and wonder whether the car is a ‘lemon’. If an individual buys a new car for £30,000 and tries to sell on the second-hand market shortly after, they may be forced to accept a much lower price, given that buyers will be suspicious of the sellers motive. Potential buyers, not having all the facts, are likely to assume the worst and expect the car to have a problem – in other words, that it is a ‘lemon’. Therefore, given that second hand cars will generally attract a low price, only those sellers who actually do have poor-quality cars will use this market. After a short period, it can be predicted that all cars sold on the second hand car market will be lemons.

When applying this concept to other markets it can be suggested that, whenever there is information failure, there is the possibility that markets will become lemons markets. This means that the supply of good-quality products will fall and the supply of poor-quality will products rise.