Economies of scale

The long run – increases in scale

A firm’s efficiency is affected by its size. Large firms are often more efficient than small ones because they can gain from economies of scale, but firms can become too large and suffer from diseconomies of scale. As a firm expands its scale of operations, it is said to move into its long run. The benefits arising from expansion depend upon the effect of expansion on productive efficiency, which can be assessed by looking at changes in average costs at each stage of production.

How does a firm expand?

A firm can increase its scale of operations in two ways.

- Internal growth, also called organic growth

- External growth, also called integration – by merging with other firms, or by acquiring other firms

By growing, a firm can expect to reduce its average costs and become more competitive.

Long run costs

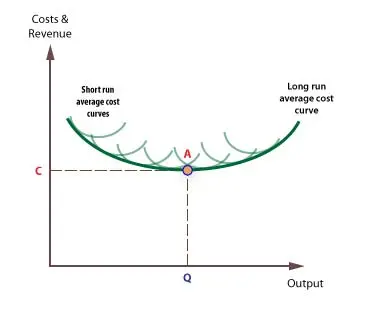

The firm’s long run average cost shows what is happening to average cost when the firm expands, and is at a tangent to the series of short run average cost curves. Each short run average cost curve relates to a separate stage or phase of expansion.

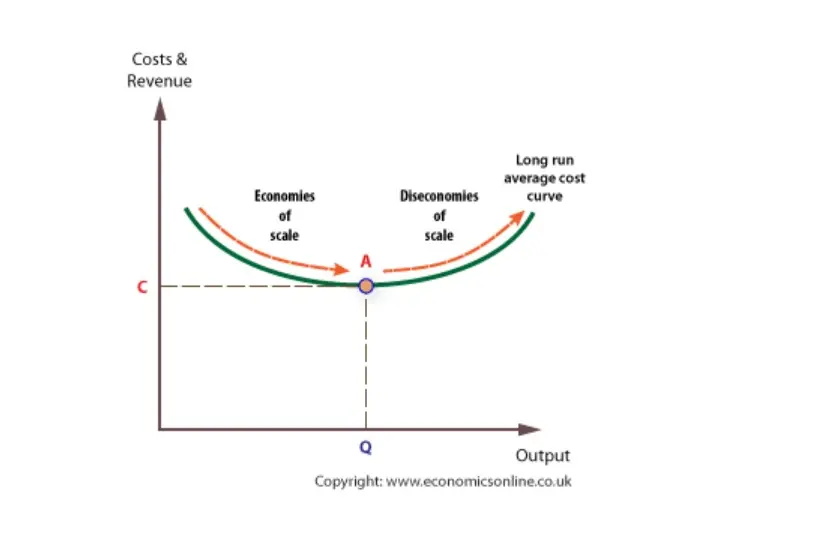

The reductions in cost associated with expansion are called economies of scale.

Internal and external economies and diseconomies of scale

External economies and diseconomies

External economies and diseconomies of scale are the benefits and costs associated with the expansion of a whole industry and result from external factors over which a single firm has little or no control.

External economies of scale include the benefits of positive externalities enjoyed by firms as a result of the development of an industry or the whole economy. For example, as an industry develops in a particular region an infrastructure of transport of communications will develop, which all industry members can benefit from. Specialist suppliers may also enter the industry and existing firms may benefit from their proximity.

External diseconomies are costs which are outside the control of a single firm and result of the growth of a specific industry. For example, negative externalities, such as road congestion, can result from the growth of an industry in a specific region. Resources may become exhausted and the price of resources may rise as demand outstrips supply.

Internal economies and diseconomies

Internal economies and diseconomies of scale are associated with the expansion of a single firm.

The long run cost curve for most firms is assumed to be ‘U’ shaped, because of the impact of internal economies and diseconomies of scale.

However, economic theory suggests that average costs will eventually rise because of diseconomies of scale.

Types of internal economy of scale

- Technical economies are the cost savings a firm makes as it grows larger, arising from the increased use of large scale mechanical processes and machinery. In the case of a mass producer of motor vehicles technical economies are likely because it can employ mass production techniques and benefit from specialisation and the division of labour. When processes can easily be scaled-up technical economies are very likely.

- Purchasing economies are gained when larger firms buy in bulk and achieve purchasing discounts. In the case of a large supermarket chain it can buy its fresh fruit in much greater quantities than a small fruit and vegetable supplier.

- Administrative savings can arise when large firms spread their administrative and management costs across all their plants, departments, divisions, or subsidiaries. For example, a large multi-national can employ one set of financial accountants for all its separate businesses.

- Financial economies exist because large firms can gain financial savings because they can usually borrow money more cheaply than small firms. This is because they usually have more valuable assets that can be used as security (collateral), and are seen to be a lower risk, especially in comparison with new businesses. In fact, many new businesses fail within their first few years because of cash-flow inadequacies.

- Risk bearing economies are often derived by large firms who can bear business risks more effectively than smaller firms. For example, a large record company can more easily bear the risk of a ‘flop’ than a smaller record label.

Diseconomies of scale

Economic theory also predicts that a single firm may become less efficient if it becomes too large. The additional costs of becoming too large are called diseconomies of scale.

Examples of diseconomies include:

- Larger firms often suffer poor communication because they find it difficult to maintain an effective flow of information between departments, divisions or between head office and subsidiaries. Time lags in the flow of information can also create problems in terms of the speed of response to changing market conditions. For example, a large supermarket chain may be less responsive to changing tastes and fashions than a much smaller, ‘local’ retailer.

- Co-ordination problems also affect large firms with many departments and divisions, and may find it much harder to co-ordinate its operations than a smaller firm. For example, a small manufacturer can more easily co-ordinate the activities of its small number of staff than a large manufacturer employing tens of thousands.

- X’ inefficiency is the loss of management efficiency that occurs when firms become large and operate in uncompetitive markets. Such loses of efficiency include over paying for resources, such as paying managers salaries higher than needed to secure their services, and excessive waste of resources. ‘X’ inefficiency means that average costs are higher than would be experienced by firms in more competitive markets.

- Low motivation of workers in large firms is a potential diseconomy of scale that results in lower productivity, as measured by output per worker.

- Large firms may experience inefficiencies related to the principal-agent problem. This problem is caused because the size and complexity of most large firms means that their owners often have to delegate decision making to appointed managers, which can lead to inefficiencies. For example, the owners of a large chain of clothes retailers will have to employ managers for each store, and delegate some of the jobs to managers but they may not necessarily make decisions in the best interest of the owners. For example, a store manager may employ the most attractive sales assistant rather than the most productive one.

Falling long run costs

Some firms may experience a continuous fall in long run average costs. These may become natural monopolies.